With Nigeria’s ever-evolving business environment, compliance is not just a legal requirement. it’s a key part of building trust and credibility for your business. Whether you run a startup, SME, or a growing company, ensuring you have the right statutory documents is crucial to avoiding penalties, accessing funding, bidding for contracts, or expanding your operations.

As a corporate law firm, we often get asked: “What documents do I need to stay compliant in Nigeria?” Here’s a simple guide to the key documents every business owner should know about:

01. CAC Registration Certificate (Corporate Affairs Commission)

What it is:

This is the official certificate that proves your

business/ company is legally registered in Nigeria.

It shows the government recognizes your

company/business.

Requirements:

- Business name, Memorandum and Articles of

Association (what you intend to do) - Names and details of directors/shareholders

- Valid means of identification

(NIN, International passport, voter’s card, etc.) - Registered address of business/company

- Proposed Share and Ownership structure

(for companies/partnerships)

Process:

- Reserve your preferred business or company name

- Complete CAC registration online via the CAC

portal - Upload required documents

- Pay the applicable fee

- Once approved, receive your CAC certificate

and status report

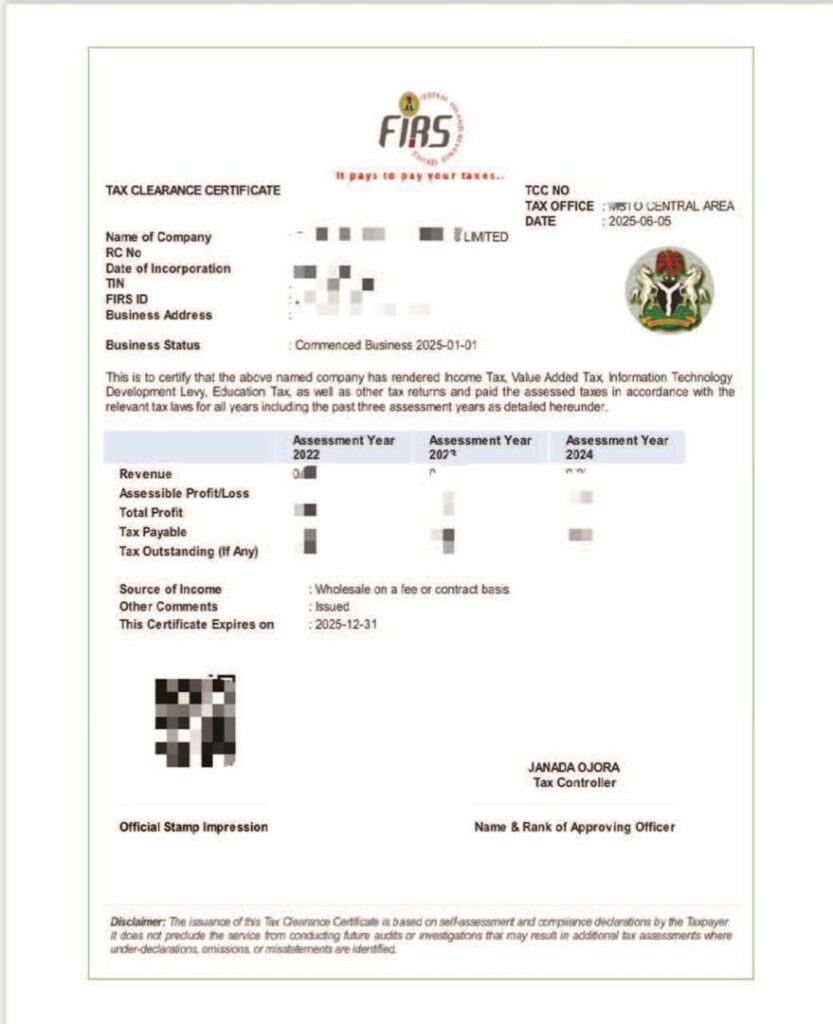

2. TCC (Tax Clearance Certificate) – From the Federal Inland Revenue Service (FIRS):

Process:

What it is:

The Tax Clearance Certificate shows that your

company has fulfilled its tax obligations up to

date.

Why it matters:

It is needed to apply for government contracts,

grants, loans, and other regulatory processes.

Requirements:

- CAC certificate

- Company’s Tax Identification Number (TIN)

- Audited financial statements

(usually for the last 1–3 years) - Evidence of payment of taxes (where applicable)

- Duly completed Annual tax returns

Process:

- Register for a TIN with FIRS

(if not already done) - File annual returns and audited accounts

- Apply for TCC online through the FIRS

TaxPro Max portal - If taxes are up to date, FIRS issues the certificate

3. NSITF (Nigeria Social Insurance Trust Fund)

What it is:

NSITF provides social insurance for employees in the event of work-related injuries or disabilities.

Why it matters:

It is mandatory for employers with 5 or more staff

and a requirement for most government contracts.

Requirements:

- Requirements:

- CAC certificate

- ID Cards of the members of staff

- List of employees and payroll information

(Staff Salary Schedule) - Compliance Letter

Process:

- Register the business with NSITF through their

office or portal - Complete the employer’s registration form

- Submit payroll and pay contributions

(1% of monthly payroll) - NSITF issues a certificate of compliance

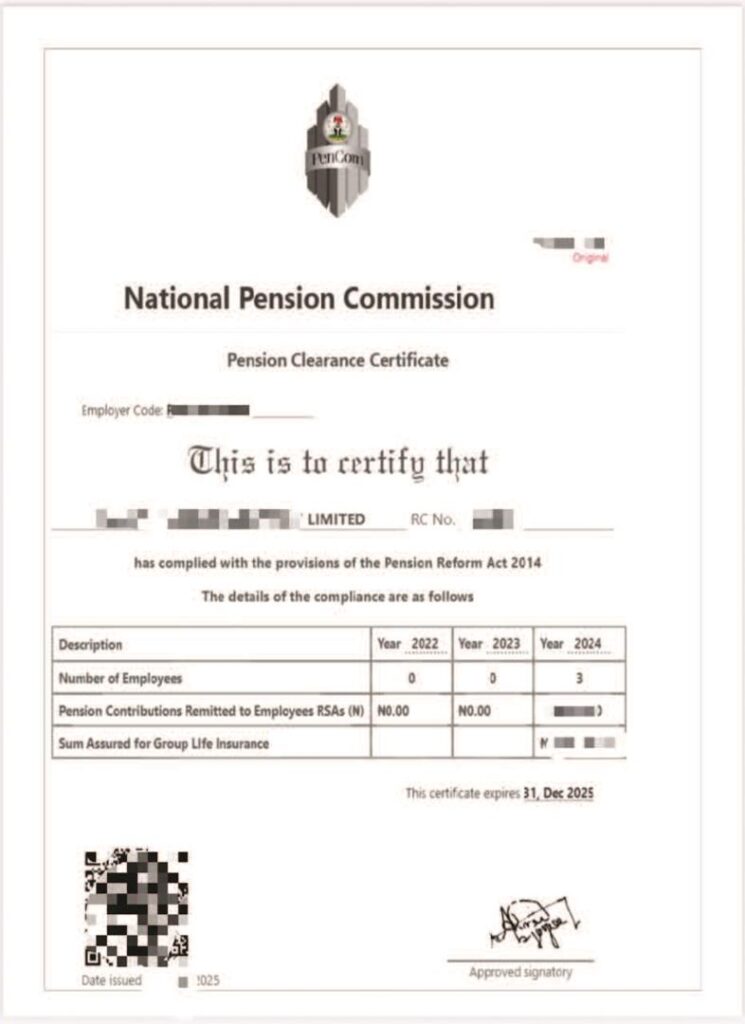

04. PENCOM Certificate (National Pension Commission)

What it is:

PENCOM ensures employers are remitting pension

contributions for their staff into the Retirement

Savings Accounts (RSA).

Why it matters:

Required for companies with 3 or more employees

and a mandatory document for public sector

contracts.

Requirements:

- CAC documents

- TIN

- Staff Salary Schedule

- Staff list and RSA PINs

(obtained from Pension Fund Administrators) - Evidence of monthly pension remittance

(minimum of 3 months) - Group Life Insurance policy for employees

Process:

- Open a pension account for each employee

through a licensed PFA - Start making monthly remittances

(10% employer, 8% employee) - Apply to PENCOM through your pension a

dministrator for compliance certificate

05. ITF Certificate (Industrial Training Fund)

What it is:

ITF develops the Nigerian workforce by mandating certain employers to contribute to staff training and development.

Why it matters:

Legally required for companies with 5 or more employees or annual turnover of ₦50 million and above.

Requirements:

- Requirements:

- CAC certificate

- TIN

- Audited accounts

- Staff list and payroll details

Process:

- Register with the nearest ITF area office

- Pay 1% of annual payroll as contribution

- Attend periodic training programs

- Apply for a Certificate of Compliance annually

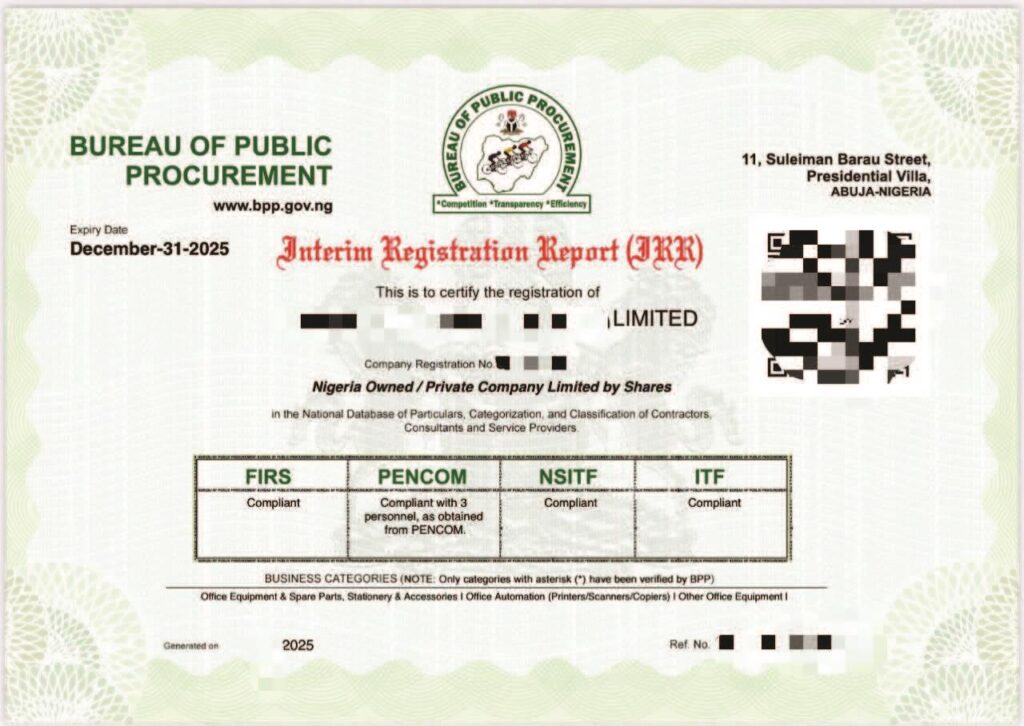

06. BPP Registration (Bureau of Public Procurement) –

What it is:

Registration with BPP’s Contractor, Consultant and Service Provider Database is essential for bidding for

federal government contracts.

Why it matters:

Without it, you can’t participate in procurement bids or be pre-qualified for public projects.

Requirements:

- CAC certificate

- Tax Clearance Certificate

- PENCOM Compliance Certificate

- ITF Compliance Certificate

Process:

- Create an account on BPP portal

- Upload all required documents

- Submit application and await approval

- Once approved, get a BPP certificate and

database ID

Regulatory Compliance isn’t just about avoiding regulatory penalties. it’s a strategic and necessary requirement for positioning your business for sustainable growth, attracting investment, forming partnerships, and participating in public procurement opportunities.

While the certificates discussed above are the basic compliance requirements applicable to most businesses, it is important to note that sector-specific regulations also apply, depending on your industry. Whether oil & gas, health, education, finance, or telecommunications additional licenses and compliance certificates may be required by regulatory bodies such as NAFDAC, SCUML, DPR/NUPRC, SEC, CBN, NITDA, and others.

We are well-positioned to guide you through both general and industry-specific compliance processes, ensuring your business is not only compliant but also ready for opportunities.

Essential Compliance documents for Businesses in Nigeria